Caroline Ellison’s Net Worth [Latest In 2024]

![Caroline Ellison’s Net Worth [Latest In 2024]](https://technologytimestoday.com/wp-content/uploads/2024/04/caroline-ellison-net-worth.jpg)

Caroline Ellison serves as the CEO and has a $15 million net worth. Before joining Alameda in 2018, Caroline was a trader on the stock desk at Jane Street.

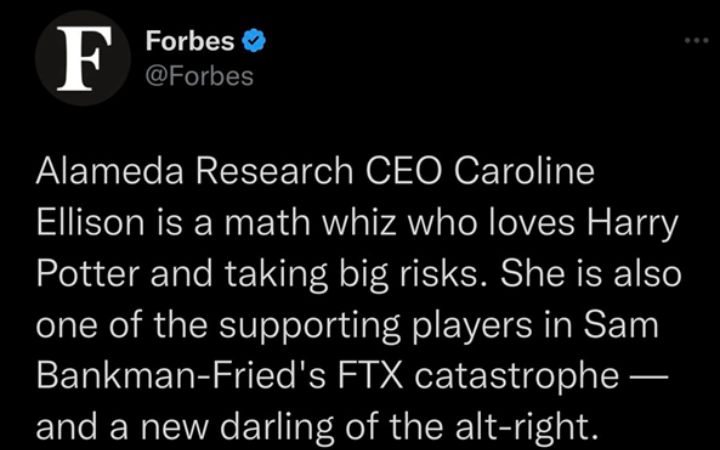

When Caroline Ellison discovered herself in the center of a financial storm in November 2022, her interest in the world of cryptocurrency took an unexpected turn. Ellison’s conduct as the CEO of renowned quant trading company Alameda Research came under harsh investigation, which caused FTX, a well-known cryptocurrency exchange, to fail.

Although opinions on her net worth differ, most analysts concur that she is pretty wealthy. According to Forbes, her net worth is around $600 million; however, Celebrity Net Worth places it closer to $700 million.

Caroline Ellison Net Worth As Of 2024?

Caroline Ellison’s projected net worth as of 2024 is $15 million. Ellison was worth millions of dollars before the current collapse of the cryptocurrency market. She retained most of her cryptocurrency assets on the exchanges run by FTX.

After the cryptocurrency exchange crisis, her money started to drop, making it harder to estimate her precise value. Caroline invested in the stock market to make money. Ellison made huge gains with her quantitative trading company, Alameda Research.

Who Is Caroline Ellison?

Caroline Ellison is the CEO of Alameda Research, a crypto business started by Sam Bankman-Fried in 2017.

Caroline Ellison’s admission into the field of economics was made possible by her upbringing in an intellectual family. Her parents, both renowned academics at the acclaimed Massachusetts Institute of Technology (MIT), fostered in her an interest in economic study from the time of her birth in November 1994. Glenn Ellison, her father and a well-known authority on industrial organization and monetary theory, greatly influenced the direction of her education.

Through her varied business endeavors, versatile businesswoman, philanthropist, and social media influencer Caroline Ellison has amassed an incredible financial empire.

Let’s examine her revenue sources:

Fashion Industry: Caroline Ellison launched a luxury fashion label to begin her career. She became well-known as the CEO and founder for her distinctive designs and creative marketing techniques. The company’s growing e-commerce platform and physical retail outlets both contribute to its revenue1.

Tech Industry: By co-founding a mobile app development firm, Ellison diversified her assets. Through partnerships with other businesses, in-app purchases, and advertising, their well-liked programs bring in a sizable income.

Investments in Startups: Her spirit of entrepreneurship inspired her to make investments in potential startups, several of which have grown into prosperous businesses. These well-calculated risks have greatly influenced her increasing fortune.

Social Media Influence: Ellison used her millions of followers on social media sites like Facebook, Instagram, and Twitter to negotiate high-paying endorsement contracts, sponsorships, and brand alliances.

The Way To Research At Alameda

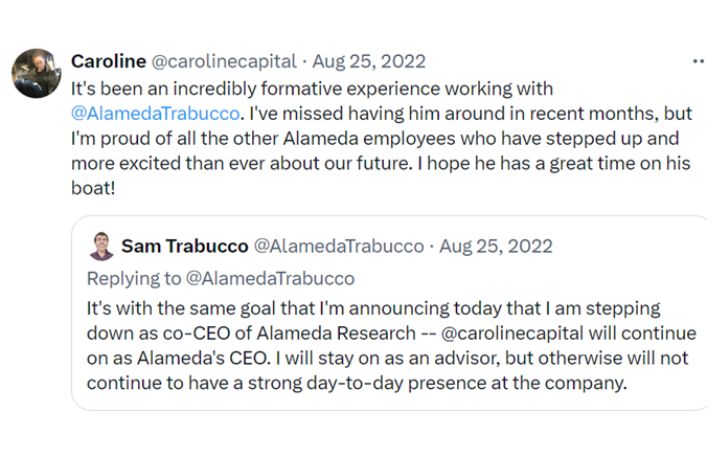

When Caroline Ellison was a student at Stanford University, she started her career in the Bitcoin field. She met Sam Bankman-Fried while working as an intern at the well-known trading company Jane Street. Having a mutual interest in the cryptocurrency industry and effective altruism, Ellison joined Alameda Research in 2018. Her career progressed quickly at the corporation, leading to her nomination as co-CEO in 2021 with Sam Trabucco.

Also Read: Urlebird Complete Review In 2024

The Fraud At Alameda Research And The Meltdown At FTX

Even though Alameda Research was successful, the company’s engagement in a contentious circumstance set off a series of events that rocked the Bitcoin world.

The $14 billion financial sheet of Alameda Research had a significant amount linked to FTT, a utility token that FTX had produced, according to a shocking revelation. Concerns over the company’s financial soundness were raised by this token’s apparent lack of significant support.

A Crisis Occurs

Following the publication of the article, rival cryptocurrency exchange Binance decided to sell its $530 million worth of FTT assets. The crypto market was rocked by this move, which caused a significant exodus of money from FTX. Customers flocked to remove $6 billion off the platform, precipitating a steep drop in the value of FTT. Sam Bankman-Fried looked for emergency credit lines, maybe with help from Binance, to calm things down.

Suit And Conversation

The Securities and Exchange Commission (SEC) and the Commodities Futures Trading Commission (CFTC) filed civil proceedings against Ellison at the same time that FTX and Alameda Research failed. The former CEO of Alameda was accused by the SEC of participating in a multiyear fraud conspiracy to defraud FTX investors. Furthermore, Ellison was charged by the SEC with manipulating the FTT price.

The regulator said in the complaint that Ellison had manipulated the price of FTT between 2019 and 2022 at the behest of SBF. Ellison and Alameda Research used automated bots to trade FTT at specific prices, as disclosed by the SEC.

Similar accusations were made by the regulator against Ellison’s Alameda Research, who changed the bots’ trading settings to boost the price of FTT.

The SEC further stated that Ellison and Alameda used these strategies to hide the true extent of the company’s risk to get further loans. Ellison, on the other hand, was accused by the CFTC of fraud and substantial misrepresentation in connection with the selling of commodities using virtual assets.

Conclusion And Our Verdict About Caroline Ellison’s Net Worth

One of the most prosperous women in the bitcoin sector at one point was Caroline Ellison. However, with the failure of FTX and Alameda, her net worth has drastically decreased, and she is currently dealing with several issues. Though it’s unknown what lies ahead for her, she’s still an intriguing character in the Bitcoin realm.

Also Read: Igpanel.net | Get Free IG Followers, Likes, Video Views In 2024

![Tallyman Axis: Registration, Login, Benefits, [Quick Guide]](https://technologytimestoday.com/wp-content/uploads/2024/07/Tallyman-Axis_.jpg)